[Link here for part 1.]

“The need to dramatically elevate college attainment is an urgent one – for our students, our families, our communities, and ultimately our nation’s future. Every capable, hard-working and responsible student should be able to access and afford higher education – and we all have a role to play to keep college part of the American Dream.” – Education Secretary Arne Duncan (18)

Economic Mobility

Eberly and Martin define, “economic mobility,” the second reason for mass-higher-education, as “the ability of children to move up and down the economic ladder independent of their parents’ economic status” (15). The authors use this chart, which looks more like death-by-credential inflation than what they argue:

…And in Eberly’s and Martin’s defense they, don’t appear too convinced either, “[E]ducation among those born in the top quintile plays a strong role in maintaining higher levels of income across generations. Children born in the top quintile who do not obtain a college degree are almost equally likely to end up in any of the five income quintiles.” Aside from the fact that this is a snapshot of generational and education levels in 2011 and not time-series data, “The Case for Higher Education” is starting to resemble the case for RBIs in baseball. Although the number of runs a batter hits home appears to indicate his offensive skill, it’s a mirage because it depends on luck and where the batter was in the lineup. Batters in the one-slot always have few RBIs because they’re guaranteed at least one at-bat where no one is on base. There are better ways of measuring offensive power in baseball.

Likewise, educational attainment doesn’t cause people to remain in the same income zone as their parents; rather, it indicates the kind of leverage wealthy families have over their children’s opportunities. Everyone else either gets lucky or hosed. Thus, if I were to predict what this graph will look like in 10 years, I’d say that in the right panel, the green, fifth quintile segments will shrink in the first four bars as the descendants of college degree-holders are less and less able to find high-paying work in a polarized society.

In the previous post, I asked you to wonder why TreasurED was going to the trouble of crafting such weak, halfhearted, and circuitous arguments for higher education. Only 5 out of 33 full-text pages are devoted to the economic argument. By contrast, 12 pages out of 33 are dedicated to “Financial Aid and Higher Education Policy,” which features a section on President Obama’s higher education actions, like accelerating the changes to IBR.

Pondering all this—to say nothing of the paper’s title-change—one might think that “The Economics of Higher Education” is more about assuaging public fears about the affordability of higher education than its necessity. Just look at the “Student Loans in Aggregate” insert on page 30:

In the second quarter of 2012, U.S. households owed an estimated $914 billion in federal student loans, making it the second largest component of household debt.51 While larger than credit card debt ($672 billion [I get $850.7 billion]) and auto loans ($750 billion), federal education debt is relatively small, only about one-ninth, compared to the size of mortgage debt ($8.1 trillion [I get $9.6 trillion]). The growth in aggregate student debt is driven by increases in the total number of individuals enrolled in college as well as increases in the percentage of students who borrow and the amount they take out. As we have discussed elsewhere in this report, financing college education is an investment: college graduates earn more and have a lower unemployment rate than those with only a high school diploma. In the United States, the average increase in lifetime earnings for an additional year of education is 7 to 10 percent.52The college wage premium is currently at its highest point since at least the mid-1960s. As with all borrowing and investment decisions, however, students and their families should carefully consider and understand the financial commitment they are making. Federal loan programs have per-year and lifetime borrowing limits, deferral options, and income-based repayment contingencies that distinguish these loans from other types of lending.

Take that, Zero Hedge doomsdayers!

You have to admit it takes a lot of finesse to say that even though we have record-shattering proportions of the population taking on debt for higher education, we simultaneously need even more to do so. Even part II of the paper shows the rapid increase in higher education enrollments in the last few years.

So why isn’t the paper titled, “Things Are Great Because We’re Sending, Like, Four Million More People to College Than in 1999”?

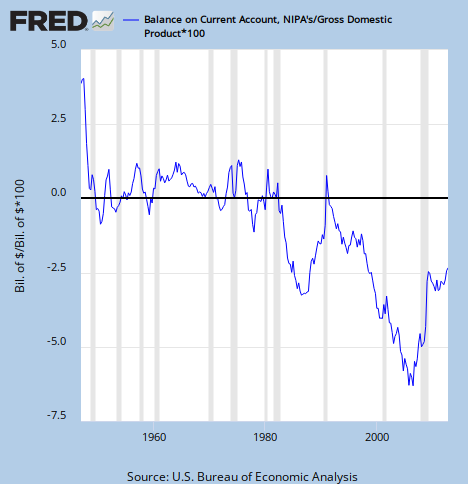

If I didn’t know any better, I’d say that the study’s authors don’t really believe what they’re saying but have to say it anyway because it’s their job. I concede that’s a harsh, basically unfalsifiable assertion, but if the Treasury is so concerned about our “competitiveness” in the global economy, why not publish a policy paper advocating weakening the dollar? The current account deficit is one of our economy’s biggest problems, and the Treasury could certainly address it a lot more easily than sending even more people to college than we already are.

Some Real Data

If high-skill jobs were in demand, then we’d expect the BLS’ employment projections to not show vast surpluses of college graduates for college-requiring jobs, so here’s the breakdown of all 54.8 million jobs that are expected to open between 2010 and 2020 by education required. (Table 1.7)

Just over a quarter of the jobs will require some kind of higher education, which should terrify us already, but just how many degrees will be conferred between 2010-2020? According to ED’s own Digest of Education Statistics, Table 279, it’s barbaric. Avert your eyes children!!

- Associate’s degrees (8,904 – 3.0x graduates/jobs)

- Bachelor’s degrees (18,065 – 2.1x graduates/jobs)

- Master’s degrees (7,606 – 8.4x graduates/jobs)

- First-Professional degree (1,100.7), Doctor’s degrees (848.4) (~1,949.1 total, 1.1x graduates/jobs (and don’t you dare say this means the law grads will be employed))

This horror raises the question: What is going to happen to college-educated Americans who can’t get skill-biased-technological-changey jobs? Will they instead take some of the top 30 jobs by growth and replacement listed in the BLS’ Table 10, which includes the all-time greats?

- Retail salespersons (1,957.7)

- Cashiers (1,775.9)

- Waiters and waitresses (1,324)

- Registered nurses (Whoah! You need an Associate’s degree for that! Back to school, again!) (1,207.4)

- Combined food preparation and serving workers, including fast food (Can you dig it?) (1,146.5)

- Office clerks, general (first on the list to require a high school degree) (1,011.5)

- Laborers and freight, stock, and material movers, hand (980.2)

- Customer service representatives (Be sure to finish high school) (959.6)

- Home health aides (837.5)

- Janitors and cleaners, except maids and housekeeping cleaners (682.0)

- Personal care workers (675.2)

- Childcare workers (HS required) (665.8)

- Heavy and tractor-trailer truck drivers (HS required) (649.4)

- Postsecondary teachers (McAdjuncts require doctoral or professional degrees) (586.1)

- Etc., it’s too depressing to continue.

How is higher education supposed to increase the wages of the souls with these jobs? Who will advocate for the material movers (hand)?

That’s a dreary quip to close on, but perhaps there is a silver lining: “The Economics of/Economic Case for Higher Education” represents the dying wheeze of the government’s we-can-be-neoliberals-too game. After you’ve borrowed money to buy stock in a bullshit Internet startup, to throw a third HELOC on a house in the desert, and to take courses on “law and the anarcho-syndicalist commune,” there will be nothing left to buy with borrowed money. In the post-debtpocalyptic wasteland, Democrats will have to run candidates who know something about wealth creation rather than ape those who redistribute it.